Introduction

“Don’t put all your eggs in one basket” is a proverb that warns against investing all of your resources in a single source. If something were to happen to that basket, you’d lose all of your eggs. To mitigate that risk, it’s wise to spread out your assets. Spreading your money across industries, broad sectors or different countries helps lessen the risk of losses in a particular area. In a volatile market, losses may be even less predictable. An investment portfolio diversification strategy can lower the volatility of your portfolio and smooth out your returns.

Types of Risk in the financial markets

There are two types of risk every investor should be aware of them. Systematic risk is the risk related to the economic system (e.g., risk related to the business cycle) that cannot be eliminated by holding a diversified portfolio such as raising interest rates. This risk is different from nonsystematic risk, defined as the unique risks of particular assets. Both internal and external issues may cause nonsystematic risk. Internal risks are tied to operational efficiencies. For example, management failing to take out a patent to protect a new product would be an internal risk, as it may result in the loss of competitive advantage. The Food and Drug Administration (FDA) banning a specific drug that a company sells is an example of external business risk. The nonsystematic risk may be avoided by holding other assets with offsetting risks.

While investors may be able to anticipate some sources of unsystematic risk, it is nearly impossible to be aware of all risks. For instance, an investor in healthcare stocks may be aware that a major shift in health policy is on the horizon, but may not fully know the particulars of the new laws and how companies and consumers will respond.

Please click For bigger size

Building a diversified portfolio

Traditionally, investors have distinguished cash, equities, bonds (government and corporate), and real estate as the major asset classes. In recent years, this list has been expanded with private equity, hedge funds, high-yield and emerging market bonds, and commodities. Within your individual stock holdings, beware of overconcentration in a single investment. For example, you may not want one stock to make up more than 5% of your stock portfolio. Diversification must involve asset classes that are not correlated (that is, they do not move in the same direction at the same time). A high positive correlation reduces the benefits of diversification. On the other hand, selecting uncorrelated or negatively correlated asset classes not only reduces the downside volatility in the performance curve of the portfolio to a minimum but can also increase overall profitability as well.

Correlation is a relatively simple concept but absolutely mandatory in the use of investments. It basically refers to whether or not different investments or asset classes will move at the same time for the same reason and in the same direction.

Strategies for Portfolio Diversification

The trouble is, that many investors may think they’re diversified. But dig in under the hood, and you’ll find more of the same, same, same across a portfolio. Here are some strategies to help investors in obtaining a good diversification

1. Individual Asset Diversification:

The strategy is to invest in an array of assets within an asset class. This can be as simple as buying the market index—the S&P 500 or the Russell 2000. A study completed from 1986 to 1999 by Ronald J. Suez and Mitchell Price of Roxbury Capital Management investment firm in California found that when portfolios have 60 stocks (or more), investors will achieve 89% diversification, meaning your portfolio is protected against volatility. Anything less than that can be detrimental to your portfolio, the research found.

2. Asset Class Diversification

The strategy is to diversify by investing across asset classes. These can include traditional investments such as stocks, bonds, and cash which operate in the public market, and alternative investments, which primarily operate in the private market and are largely unregulated.

3. International Market Diversification

The strategy is to look abroad. If your country’s market were to perform poorly, it’s useful to have some investments in international markets to mitigate risk and balance your portfolio.

Building a diversified portfolio example

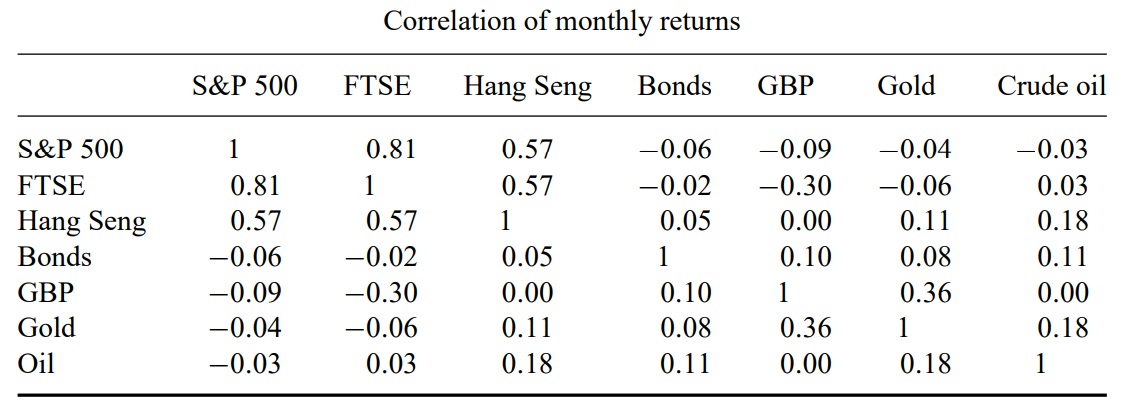

Table 1.1, shows the average yearly percentage returns and standard deviation of returns of multiple asset classes. The correlation coefficients between the selected asset classes or indices are listed in Table 1.2. These coefficients are based on monthly percentage yields and are calculated, as part of this study, over the same 10-year period

Table 1.1

Please click For bigger size

Table 1.2

Please click For bigger size

A comparison of the returns, standard deviation, and risk-adjusted returns of the four hypothetical passive portfolios show the real effect of diversification (Table 1.3). The first portfolio (in the third column of Table 1.3) contained a typical allocation of asset classes found in an average US fund, i.e. 70 % equities, 20 % bonds, and 10 % money market. By including uncorrelated assets such as bonds and cash (with zero correlation with the S&P), a risk reduction of 31 % was achieved with only a 1.4 % reduction in returns. A further 5 % risk reduction was accomplished by including international equities (10 % British and 10 % Hong Kong equities). The main reason for including international equities was to improve on US equity returns, but this was not the case in the hypothetical portfolio as the Hang Seng underperformed the S&P 500 during the 1997–1998 Asian financial crisis. Commodities, however, were the real star of the show as they played an important role in significantly reducing risk and, at the same time, increasing return. This is evident from the standard deviation of returns of the third hypothetical portfolio. A huge 64 % reduction in risk was achieved by including gold (10 %) and crude oil futures (10 %), even though the standard deviation (and risk) of investing in crude oil alone was more than double that of the S&P. The fourth portfolio was obtained by finding the best allocation (highest return) with the minimum risk. This produced a portfolio consisting of 30 % US equities, 55 % bonds, and 15 % oil futures. The relatively high percentage allocation of bonds. was to be expected as their standard deviation was the lowest of the group. The presence of the highly volatile oil futures in the minimum risk portfolio, however, was certainly a surprise. This portfolio reduced risk by an astonishing 64 %, sacrificing only 1.2 percentage points in return compared to the equities-only portfolio.

Table 1.2

Please click For bigger size

Conclusion

Achieving your long-term goals requires balancing risk and reward. Choosing the right mix of investments and then periodically rebalancing and monitoring your choices can make a big difference in your outcome.

The content published above has been prepared by CFI for informational purposes only and should not be considered as investment advice. Any view expressed does not constitute a personal recommendation or solicitation to buy or sell. The information provided does not have regard to the specific investment objectives, financial situation, and needs of any specific person who may receive it, and is not held out as independent investment research and may have been acted upon by persons connected with CFI. Market data is derived from independent sources believed to be reliable, however, CFI makes no guarantee of its accuracy or completeness, and accepts no responsibility for any consequence of its use by recipients.