What is a trend?

Despite only showing up 30% of the time, compared to ranging conditions prevailing around 70% of trading sessions, trend trading is a popular and easy to get into strategy that can give you an edge if approached properly.

Trends manifest themselves as a continuously rising or declining price of a trading product. Trends are not linear and prices will not go from point A to point B in one go. Instead, they include ups and downs, regardless of the ultimate direction. Imagine a set of stairs, and you are going up. Each step is a bit higher then there is a small pause before reaching the step after it. It’s the same way with trends as price goes higher then pauses for a bit before continuing even higher. The opposite is true for downtrends.

Trends can be seen on very small timeframes but can also happen over very long periods including days, weeks, months, and even years. Within trends, price action can include opposing shorter trend trends as well as ranging conditions that happen during more shallow corrections and pauses.

Identifying a trend

The idea of identifying a trend is fairly (Figure1,2) straightforward and should be achievable by simply looking at a chart. Some traders prefer using indicators or traditionally tracking prices on a piece of paper but given the technology available out there, a chart should suffice when trying to identify if a market is ranging or trending.

Figure 1

Please click For bigger size

Figure 2

Please click For bigger size

How to trade with the trend

There are different ways in which a trader can trade with the trend. Some may look to get in on a break of major support/resistance which could mark the start of a new trend while others may prefer looking for an established trend and getting in on the correction. Whichever method you decide to use, remember that there are a few things that can help you achieve greater efficiency.

There is a saying in the financial markets that says “The Trend is Your Friend”. This saying is widely spread across traders and it states the fact that you have to look for opportunities only that coincide with the prevailing trend direction.

For example, if the overall trend seems to be to the upside, hence a trader should try to identify long signals and confirmations that confirm the upside movement, and whenever the trend is directed downwards (Figure 3), then the trader should try to look for short signals.

However, despite being true most of the time, sometimes the market provides us with signals that can work in the correction movements that are usually against the original trend. This is where the experience of the trader is on a test, whereby decisions should be made strictly based on studied strategies.

We have multiple ways of trading trends as stated before, either through entering with a trend that was previously identified or through trading the beginning of new trends.

Figure 3

Please click For bigger size

Indicators

Trading Indicators are essential tools to analyze price movements based on their historical activity to try and forecast future movements.

Usually, in analyzing indicators, traders mistake forecasts with predictions and tend to take decisions solely based on what the indicators are showing.

However, they should be used as a combination that generates signals and confirmations.

Indicators are mathematically created equations that are derived from historical price movements and price data.

We have thousands of trading indicators that are organized under specified categories based on the nature of the equation.

The most known categories are:

- Trend indicators

- Momentum Indicators

- Volume Indicators

- Volatility Indicators

Trend indicators Indicate the market trend, whether to the upside or the downside, along with possible reversals and continuation confirmations.

The most common trend indicators are the moving average convergence divergence (MACD), Ichimoku Kinko Hyo, Moving Averages, and Parabolic Sar. Below are some examples of the different indicators:

MACD

Figure 4

Please click For bigger size

Ichimoku Kinko Hyo

Figure 5

Please click For bigger size

Moving Averages are plotted by adding up a predefined set of data points based on a specific period and divided by the period time.

We have different equations for different sets of moving averages, such as the simple moving average, exponential moving average, smoother moving average, and linear weighted moving average.

To simplify the process, let’s use the simple moving average, which is mostly used to forecast longer-term trends.

Taking a look at the above figure (Figure 4) the moving averages used are the 50SMA (Blue Line), 100SMA (Orange Line), and the 200SMA (Black Line).

What we can analyze from this chart is that whenever the price is above all the moving averages, then the trend is very bullish.

Another bullish characteristic is that the smaller moving averages are above the larger moving averages. As we can see the 50 SMA is above the 100SMA which is also above the 200SMA. So as long as those characteristics are met this means that the trend is up.

Another thing to keep an eye on is the number of times the price tests the 50SMA while failing to breach it to the downside. This means that the price is surfing on this specific moving average which is currently acting as support.

Moving Averages

Figure 6

Please click For bigger size

Price action

Price action is the foundation of technical analysis. It is exclusively used by many traders around the world.

To simplify it, we should understand the supply and demand of the specific instrument we are analyzing

Demand zones (Support) are (Figure 7) are defined as areas where traders are stepping in, buying, and lifting prices higher. In other words, they are areas where demand comes in.

Supply zones (Resistance) are areas where traders are selling and pushing prices lower. In other words, supply is coming in around those areas or levels.

In a ranging market or if prices are moving between clear support and resistance, traders can benefit from both, buying and selling, depending on where the market is currently at.

Figure 7

Please click For bigger size

When prices are testing a support line or a zone that has been tested more than once, this might give us buying opportunities. However, to further empower our decisions, extra confirmation might be needed.

On the other hand, if prices are testing clear resistance and strong supply zones, selling might be a good idea.

Another important price action element is the trendline. When trendlines, Demand/Supply zones, or Support/Resistances are combined, they create a clearer picture of market conditions.

Trendlines are plotted based on the direction of the price, whether it is upwards or downwards. Prices tend to move in either impulsive movements, or corrections.

Upward Trend

To identify an uptrend (Figure 8), we need two main elements: Higher Highs and higher lows.

In the case of increasing momentum, the price moves impulsively to the upside and then during the correction, it moves slightly to the downside. As long as the correction is not equal to the impulsive move, then prices will remain to the upside.

Figure 8

Please click For bigger size

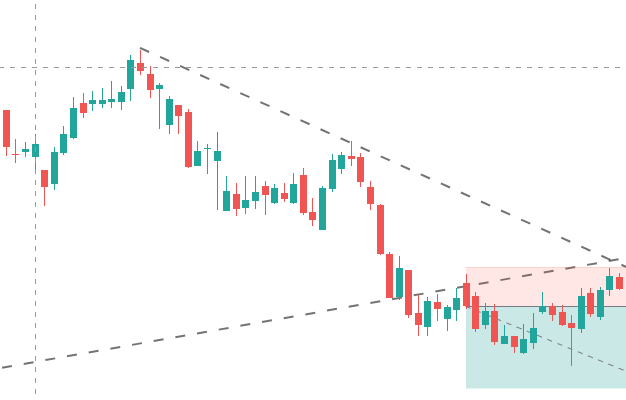

Downward Trend

To highlight a downward trend(Figure 9), we need two main elements: Lower Highs and Lower Lows.

In the case of decreasing momentum, the price moves impulsively to the downside and then during the correction, it moves slightly to the upside. As long as the correction is not equal to the impulsive move, then prices will remain to the downside.

To trade the trends, we need to identify the market structure, as in where is the market standing at that specific point. To answer this question, we need to ask ourselves other questions. Is the overall trend up or down? Are we close to a support or resistance zone?

Figure 9

Please click For bigger size

Breakouts

In price breakouts, we are talking about the possibility of having a reversal. This means that if the price is moving up and a breakout of that trend occurs, this might mean that the price might be creating a new trend. We have multiple ways to trade breakouts.

- Instant Execution

- Retest After Breakout

- Trend Confirmation

Instant Execution

Let’s look at an example of an (Figure 10) upward trend that witnesses a breakout. The instant execution breakout trading strategy will include selling once the trend is broken with one candle at a specified timeframe. The limitation of this strategy is the possibility of a fake breakout.

Figure 10

Please click For bigger size

Retest After Breakout

We will look at the same example (Figure 11) but we will consider entering on the retest after the breakout. The limitation is that the retest might not occur

Figure 11

Please click For bigger size

Trend Confirmation

The last scenario is to enter on the (Figure 12) downward trend confirmation, whereby the new trendline is formed. The limitation is that the trend might be impulsive and the price might decrease to new lows and will never give you a chance to enter at the price you want.

Figure 12

Please click For bigger size

Putting it together

As you can see, trading trendlines is simple yet it can be done through different ways. Some are safer but less likely to occur while others are riskier but provide more frequent opportunities.

To limit those probabilities or minimize the number of scenarios, further confirmations might be needed, such as indicators, and other chart patterns.

However, identifying the structure of the trend and location of the price compared to its previous position will help the trader in making informed decisions.