FX Market

Last week, the Dollar Index was trading lower by 0.72%, despite talks from the Fed about higher rates. On the 22nd of March, the Federal Reserve set the rate at 5.00%, increasing it by 25 basis points from the previous, taking a cautious stance due to the banking sector crisis. After the press conference, Federal Reserve Chairman Jerome Powell confirmed that there were discussions about pausing rates, which caused a weakening of the U.S. Dollar in the market. However, he also mentioned that he is willing to consider additional rate hikes if necessary.

The market is keeping a close eye on the upcoming release of the Personal Consumption Expenditures (PCE) price index, scheduled on March 31 at 4:30 PM (+GMT4), as it could provide insights into how it may impact future rate decisions. On Friday the 24th of March, the EUR/USD pair experienced a decline of 0.64%, with a closing price of $1.08. The Euro was negatively affected as investors were concerned about the state of Europe’s Banking industry.

Furthermore, on the 24th of Friday, the USD/JPY pair experienced a drop of 0.07%. The Japanese Yen rose in value when the Flash Manufacturing PMI was released, which surpassed market expectations resulting in 48.6.

Last week the GBP/USD pair witnessed an increase of 0.23%, due to the Core Consumer Price Index (CPI) increasing from 5.8% to 6.2%. Furthermore, the official Bank rate raised interest rates by 25 basis points to battle inflation.

Equity Market

During the week, US equity returns showed a significant range of fluctuations, as concerns about the banking sector and the possibility of an economic recession had a negative impact on the performance of value stocks and small-cap companies. In contrast, large-cap growth stocks experienced gains.

The S&P 500 index saw an increase of 1.4%, the Nasdaq index gained 1.7%, and the Dow Jones index gained 1.2% the previous week as the Market continues to price in about 100 basis points of rate cuts for this year, defying the Fed’s latest dot plot projections.

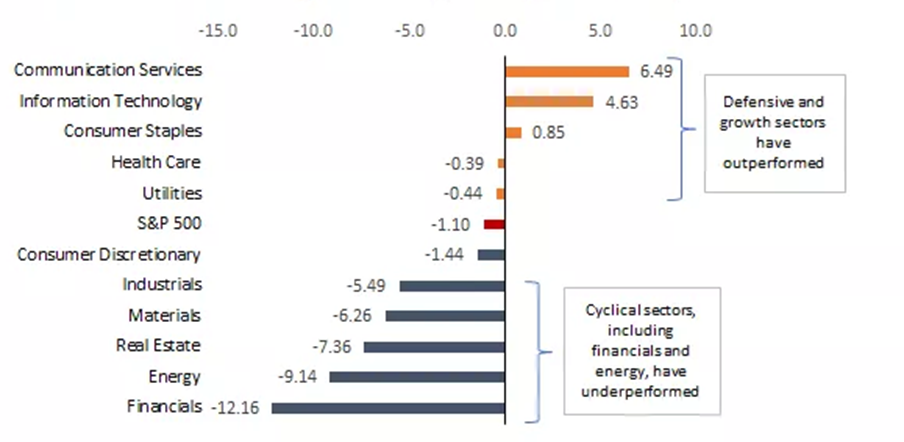

Since the beginning of the year, the banking sector globally underperformed the broader market with the collapse of Silicon Valley Bank followed by others including one of the largest and oldest banks in Switzerland, Credit Suisse. Therefore, investors are opting for defensive stocks which were outperforming during March amid the challenging economic environment (Figure 1). During the past week, UBS acquired Credit Suisse.

Figure 1: S&P Sector Performance (March 7th-24th) | Source: Bloomberg

Commodities Market

Last week, WTI and Brent retrieved partial losses from March 13th. WTI was up 4.48% and Brent 2.72%. The modest rebound was a feeble comeback from a -13.55% drawback for WTI and -12.30% for Brent the week prior. Both retested their 200-week exponential moving average from which they rebounded with weak momentum. WTI weekly resistance level $77.42 and $83.42 for Brent. Support levels are $64.41 for WTI and $70.17 for Brent.

On another note, Saudi Aramco announced its plan to build a $10 billion refinery complex in China, taking advantage of the country’s growing fuel demand. The refinery is planned to have the production capacity of 300,000 barrels. The project is set to take over the next three years.

Gold prices fell last week by 0.6% after the Federal Reserve raised interest rates by 25 basis points to reach 5%, and the Fed stressed that they are continuing to fight inflation. And there may be an additional hike in interest rates, but that depends on the economic data.

The markets are anticipating three important economic data this week that are expected to have an impact on gold prices, first, consumer confidence on Tuesday, gross domestic product on Thursday, and finally, consumer spending price index, which is the Fed's favorite indicator, is expected to rise by 0.4%, lower than the previous reading of 0.6%.

Technically: (Figure 1), gold tried last week to breach levels close to $2,000 an ounce, but it rebounded from there. Currently, it is trading between the support area near $1966 and resistance at $2,000 an ounce. We will watch if gold succeeds this week by the 2000$ per ounce level.

Figure 1: XAUUSD, Metatrader 5, CFI Brokerage

The content published above has been prepared by CFI for informational purposes only and should not be considered as investment advice. Any view expressed does not constitute a personal recommendation or solicitation to buy or sell. The information provided does not have regard to the specific investment objectives, financial situation, and needs of any specific person who may receive it, and is not held out as independent investment research and may have been acted upon by persons connected with CFI. Market data is derived from independent sources believed to be reliable, however, CFI makes no guarantee of its accuracy or completeness, and accepts no responsibility for any consequence of its use by recipients.