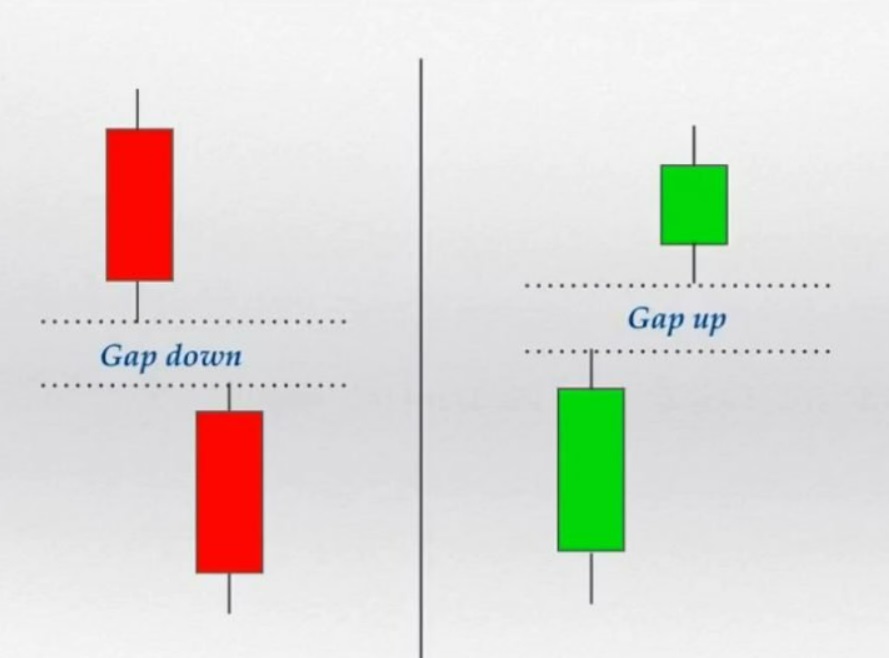

Price gaps are simply areas on the chart where no trading has taken place. In an uptrend, for example, prices open above the highest price of the previous day, leaving a gap or open space on the chart that is not filled during the day. In a downtrend, the day's highest price is below the previous day's low as shown in figure (1). Upside gaps are signs of market strength, while downside gaps are usually signs of weakness.

Gaps can appear in all timeframes, Gaps on daily charts are produced when the lowest price at which a certain asset is traded on any one day is higher than the highest price at which it was traded on a preceding day. For a gap to develop on a weekly chart, it is necessary for the lowest price recorded at any time in one week to be higher than the highest recorded during any day of the preceding week.

figure (1)

Please click For bigger size

Types of Gaps

Technical analysis manuals define the four types of gap patterns as Common, Breakaway, Continuation, and Exhaustion.

1- The Breakaway Gap.

The breakaway gap usually occurs at the completion of an important price pattern, and usually signals the beginning of a significant market move. After a market has completed a major basing pattern, the breaking of resistance often occurs on a breakaway gap. Major breakouts from topping or basing areas are breeding grounds for this type of gap. The breaking of a major trendline, signaling a reversal of trend, might also see a breakaway gap. As shown in figure (2)

Breakaway gaps usually occur on heavy volumes. More often than not, breakaway gaps are not filled. Prices may return to the upper end of the gap (in the case of a bullish breakout), and may even close a portion of the gap, but some portion of the gap is often left unfilled. As a rule, the heavier the volume after such a gap appears, the less likely it is to be filled. Upside gaps usually act as support areas for subsequent market corrections. It's important that prices not fall below gaps during an uptrend. In all cases, a close below an upward gap is a sign of weakness.

Breakaway Gaps also develop at times when prices move out of other types of Reversal or Consolidation Formations.

figure (2)

Please click For bigger size

2- The Runaway or Measuring Gap

After the move has been underway for a while, somewhere around the middle of the move, prices will leap forward to form a second type of gap (or a series of gaps) called the runaway gap. This type of gap reveals a situation where the market is moving effortlessly on moderate volume. In an uptrend, it's a sign of market strength; in a downtrend, a sign of weakness. Here again, runaway gaps act as support under the market on subsequent corrections and are often not filled. As in the case of the breakaway, a close below the runaway gap is a negative sign in an uptrend. As shown in figure (3)

It is also called a measuring gap because it usually occurs at about the halfway point in a trend. By measuring the distance, the trend has already traveled, from the original trend signal or breakout, an estimate of the probable extent of the remaining move can be determined by doubling the amount already achieved.

The Continuation or Runaway type are of far greater technical significance because they afford a rough indication of the probable extent of the move in which they occur. For that reason, they have sometimes been called “Measuring” Gaps.

figure (3)

Please click For bigger size

3- The Exhaustion Gap.

The final type of gap appears near the end of a market move. After all objectives have been achieved and the other two types of gaps (breakaway and runaway) have been identified, the analyst should begin to expect the exhaustion gap. Near the end of an uptrend, prices leap forward in the last gasp, so to speak. However, that upward leap quickly fades and prices turn lower within a couple of days or within a week. When prices close under that last gap, it is usually a dead giveaway that the exhaustion gap has made its appearance. This is a classic example where falling below a gap in an uptrend has very bearish implications.

Exhaustion Gaps, like Runaway Gaps, are associated with rapid, extensive advances or declines. We have described the Runaway type as the sort that occurs in the midst of a move that accelerates to high velocity and then slows down again and finally stops as increasing Resistance overcomes its momentum. Sometimes, however, “skyrocket” trends evidence no such gradual increase of Resistance as they proceed, showing no tendency to lose momentum, but rather continue to speed up until, suddenly, they hit a stone wall of supply (or, in cases of a decline, demand) and are brought to an abrupt end by a day of terrific trading volume

Runaway Gaps are usually not covered for a considerable length of time, as a rule, not until the market stages a swing of Major or full Intermediate proportions in the opposite direction. But Exhaustion Gaps are quickly closed, most often within two to five days, a fact that furnishes a final clue to distinguish Exhaustion from Continuation

In the case of the Exhaustion Gap, the closing of it actually contributes to the signal the trend has run out.

The Breakout Gap signals the start of a move; the Runaway Gap marks its rapid continuation at or near its halfway point, and the Exhaustion Gap comes at the end.

4- Common Gaps (area Gap)

Gaps that occur within a trading range (considered insignificant) Such Pattern Gaps are usually closed within a few days, and for obvious reasons. they usually don’t provide exciting trading opportunities.

Please click For bigger size

Please click For bigger size

5- The Island Reversal

Sometimes after the upward exhaustion gap has formed, prices will trade in a narrow range for a couple of days or a couple of weeks before gapping to the downside. Such a situation leaves the few days of price action looking like an “island” surrounded by space or water. The exhaustion gap to the upside followed by a breakaway gap to the downside completes the island reversal pattern and usually indicates a trend reversal of some magnitude. Of course, the major significance of the reversal depends on where prices are in the general trend structure.

An Island Reversal might be described as a compact trading range separated from the move that led to it (and that was usually fast) by an Exhaustion Gap and from the move in the opposite direction that follows it (and that is also equally fast, as a rule) by a Breakaway Gap.

Please click For bigger size

The content published above has been prepared by CFI for informational purposes only and should not be considered as investment advice. Any view expressed does not constitute a personal recommendation or solicitation to buy or sell. The information provided does not have regard to the specific investment objectives, financial situation, and needs of any specific person who may receive it, and is not held out as independent investment research and may have been acted upon by persons connected with CFI. Market data is derived from independent sources believed to be reliable, however, CFI makes no guarantee of its accuracy or completeness, and accepts no responsibility for any consequence of its use by recipients.